Wesley Pinheiro, CVM Investment Consultant

True wealth is having free time. Money is merely the fuel for that wealth.

-

Consulting for investors seeking validated strategies, detailed analysis, and proven results.

-

Consulting for investors seeking validated strategies, detailed analysis, and proven results.

Wesley Pinheiro, CVM Investment Consultant

True wealth is having free time. Money is merely the fuel for that wealth.

-

Consulting for investors seeking validated strategies, detailed analysis, and proven results.

Investment Consulting

Personalized guidance and support in fixed income, stocks, REITs, FIAGROS, international investments, crypto assets, and startups.

Investment Consulting

Financial Consulting

Personalized guidance and support in financial education, investment initiation, financial planning, tax planning, retirement planning, and estate planning.

Financial Consulting

Business Consulting

Support, implementation, and monitoring in business models and plans, cash flow, marketing, budgeting, and financial planning.

Business Consulting

Investment Consulting

Personalized guidance and support in fixed income, stocks, REITs, FIAGROS, international investments, crypto assets, and startups.

Investment Consulting

Financial Consulting

Personalized guidance and support in financial education, investment initiation, financial planning, tax planning, retirement planning, and estate planning.

Financial Consulting

Business Consulting

Support, implementation, and monitoring in business models and plans, cash flow, marketing, budgeting, and financial planning.

Business Consulting

9

Years of Experience

9 years of experience

CVM Consultant

Investment Specialist (Anbima)

Business Consultant

Business Administrator

9 years of experience

CVM Consultant

Investment Specialist (Anbima)

Business Consultant

Business Administrator

Transform your assets into results, whether through long-term investments or quick operations in the market.

If you are facing difficulties in achieving your financial goals, don’t worry. Our data-driven solutions are designed to meet the needs of a wide variety of investors.

We develop tailored portfolios and ensure their careful management. This detailed approach is essential to our commitment to helping you generate income and increase your wealth, using everything from more traditional investment options to advanced and profitable tactics.

Did you like the proposal? Schedule an informal conversation and discover how we can collaborate to help you achieve your financial objectives.

Wesley Pinheiro

9 years of experience

CVM Consultant

Investment Specialist (Anbima)

Business Consultant

Business Administrator

"The cost of focusing on short-term tactics instead of investing in long-term strategies is the money you miss out on accumulating over time."

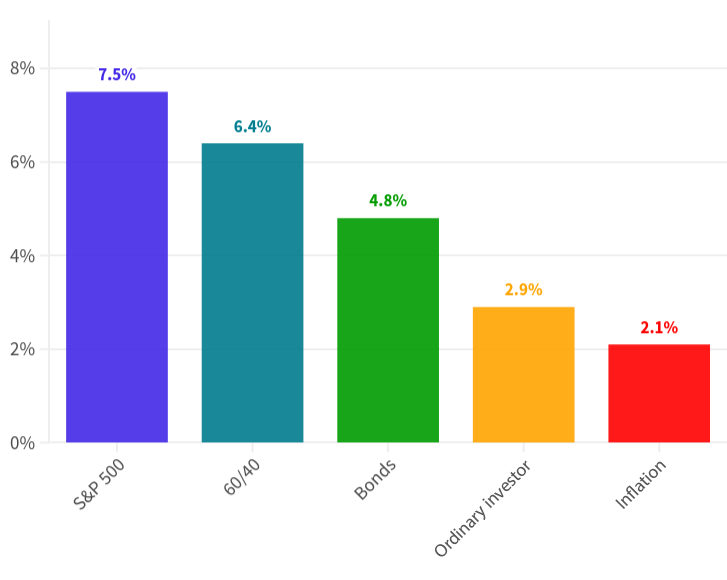

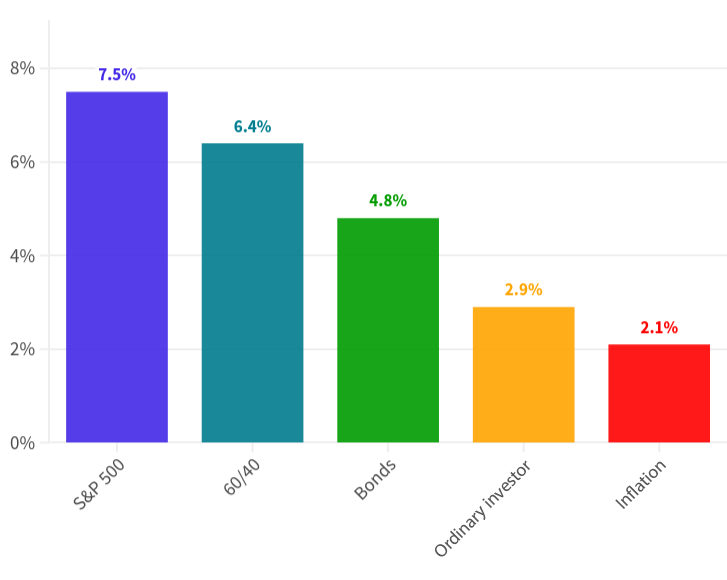

According to studies by the American bank J.P. Morgan, retail investors often fail to outperform simple investments, such as funds that track the S&P 500 and even government bonds (bonds). This happens mainly due to a lack of discipline, ineffective strategies, and attempts at market “timing,” which end up harming returns over time.

Annualized Average Returns from 2001 to 2020

Gross values before taxes and inflation.

Source: Barclays, Bloomberg, FactSet, Standard & Poor’s, J.P. Morgan Asset Management; Dalbar Inc, MSCI, Russell. Indices used: Bonds: Bloomberg Barclays U.S. Aggregate Index, Inflation: CPI. 60/40: A portfolio with 60% in the S&P 500 index and 40% in high-grade U.S. fixed income, represented by the Bloomberg Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. The average investor return is based on analysis by Dalbar Inc., which uses net sales, redemptions, and exchanges of mutual funds aggregated each month as a measure of investor behavior. Market Guide – U.S. Data as of September 30, 2021.

According to studies by the American bank J.P. Morgan, retail investors often fail to outperform simple investments, such as funds that track the S&P 500 and even government bonds (bonds). This happens mainly due to a lack of discipline, ineffective strategies, and attempts at market “timing,” which end up harming returns over time.

Annualized Average Returns from 2001 to 2020

Gross values before taxes and inflation.

Source: Barclays, Bloomberg, FactSet, Standard & Poor’s, J.P. Morgan Asset Management; Dalbar Inc, MSCI, Russell. Indices used: Bonds: Bloomberg Barclays U.S. Aggregate Index, Inflation: CPI. 60/40: A portfolio with 60% in the S&P 500 index and 40% in high-grade U.S. fixed income, represented by the Bloomberg Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. The average investor return is based on analysis by Dalbar Inc., which uses net sales, redemptions, and exchanges of mutual funds aggregated each month as a measure of investor behavior. Market Guide – U.S. Data as of September 30, 2021.

In 2014, the brokerage firm Fidelity made an interesting discovery: its most profitable clients were those who simply did not touch their portfolios, whether because they forgot they had an account or because they had passed away. This fact reveals a valuable lesson about the behavior of retail investors, who often sabotage their own results by making emotional decisions, trying to predict market movements, and preferring short-term tactics over well-structured strategies.

This incessant search for “must-have opportunities” leads many to build their portfolios randomly. They buy stocks, apply trading systems, and invest in various funds, but without considering how these assets complement each other. The result is a “mishmash” portfolio—disorganized and lacking a clear direction—similar to a sandwich with chocolate, sashimi, and pork cracklings—no matter how much you like each one, they just don’t work together.

This behavior is common among investors who focus on each individual asset but neglect the impact that their combination has on the volatility and returns of the portfolio as a whole. Without coherent planning, the investor ends up suffering from unnecessary fluctuations and results that fall short of expectations. Building a portfolio requires more than just selecting good assets in isolation; it’s essential to create a balanced portfolio aligned with your financial goals.

"The average investor chooses their assets as if they were at a buffet of financial options, and without a clear strategy, they end up with a 'messy' portfolio that doesn't yield results."

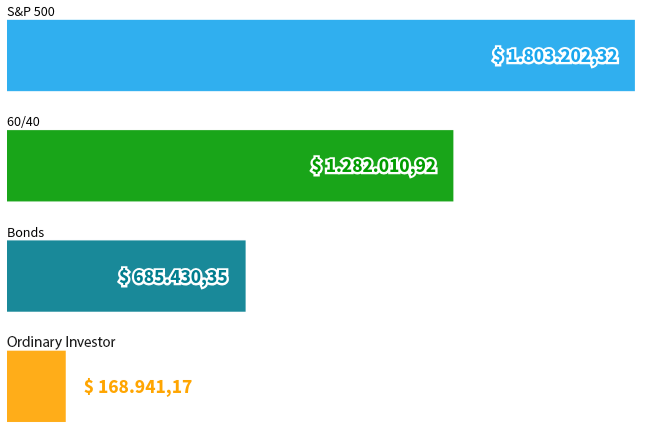

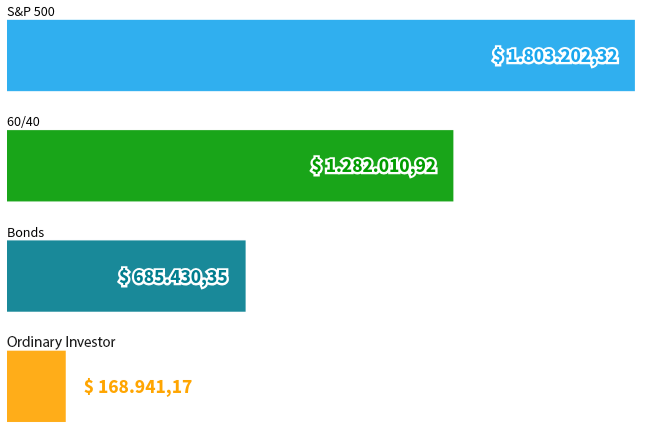

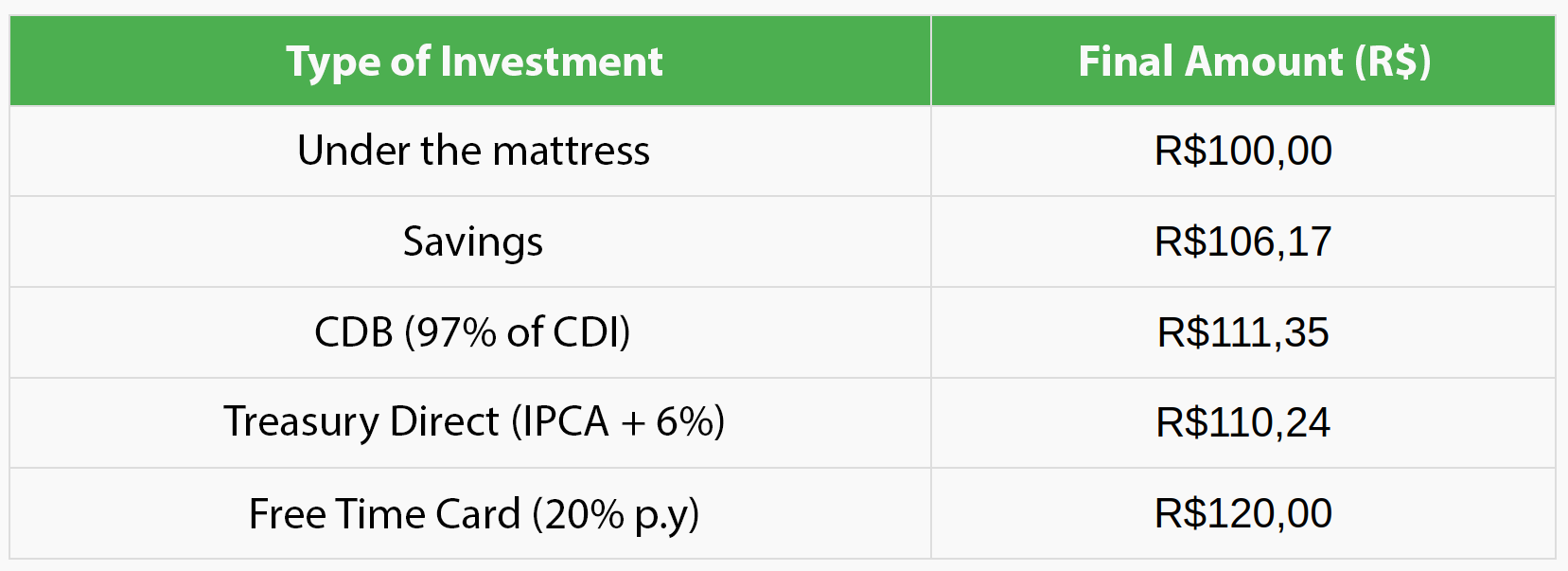

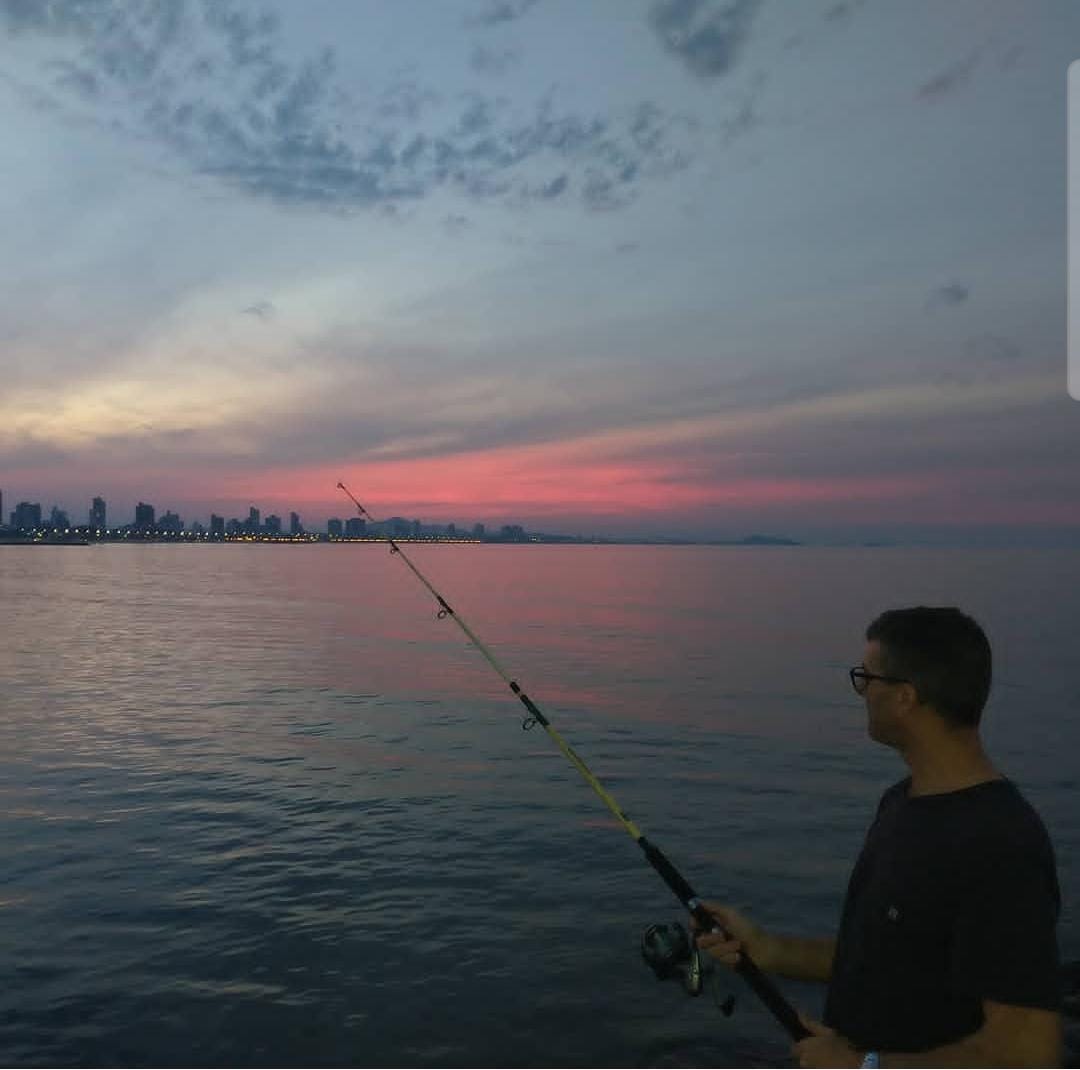

Real Profits (Above Inflation) Accumulated Over 20 Years

With an investment of $1 million, the average investor earned 4 to 10 times less than basic strategies in the American market.

Source: Barclays, Bloomberg, FactSet, Standard & Poor’s, J.P. Morgan; Dalbar Inc, MSCI, Russell. Indices used: Bonds: Bloomberg Barclays U.S. Aggregate Index, 60/40: A portfolio with 60% in the S&P 500 index and 40% in high-grade U.S. fixed income. The portfolio is rebalanced annually. The average investor return is based on analysis by Dalbar Inc., which uses net sales, redemptions, and exchanges of mutual funds aggregated each month as a measure of investor behavior. Market Guide – U.S. Data as of September 30, 2021. The simulation with $1 million can be easily adapted for other amounts, so $100,000 would have yielded 10% of the mentioned amounts (i.e., $168,941.17 for an investment of $100,000 would have yielded $16,894.12 or 16.89% of the initially invested amount).

Real Profits (Above Inflation) Accumulated Over 20 Years

With an investment of $1 million, the average investor earned 4 to 10 times less than basic strategies in the American market.

Source: Barclays, Bloomberg, FactSet, Standard & Poor’s, J.P. Morgan; Dalbar Inc, MSCI, Russell. Indices used: Bonds: Bloomberg Barclays U.S. Aggregate Index, 60/40: A portfolio with 60% in the S&P 500 index and 40% in high-grade U.S. fixed income. The portfolio is rebalanced annually. The average investor return is based on analysis by Dalbar Inc., which uses net sales, redemptions, and exchanges of mutual funds aggregated each month as a measure of investor behavior. Market Guide – U.S. Data as of September 30, 2021. The simulation with $1 million can be easily adapted for other amounts, so $100,000 would have yielded 10% of the mentioned amounts (i.e., $168,941.17 for an investment of $100,000 would have yielded $16,894.12 or 16.89% of the initially invested amount).

"We apply data science and statistics to develop simple and effective strategies, helping our clients move beyond frustration and achieve solid results."

Smart Investments: Our Methods in Action

We develop customized portfolios based on academic research, in-depth analysis, and continuous backtesting, ensuring informed decisions and consistent results.

Do you plan to retire?

Start investing early!!

Examples:

If you begin investing R$1,000.00 per month with the goal of retiring at 60, considering a gross monthly return of 1% (without accounting for INFLATION), you would have:

Starting at 50: R$232,339.10

Starting at 40: R$999,147.92

Starting at 30: R$3,529,913.77

Starting at 20: R$11,882,420.24

Starting at 10: R$39,448,923.10

Smart Investments: Our Methods in Action

We develop customized portfolios based on academic research, in-depth analysis, and continuous backtesting, ensuring informed decisions and consistent results.

Do you plan to retire?

Start investing early!!

Examples:

If you begin investing R$1,000.00 per month with the goal of retiring at 60, considering a gross monthly return of 1% (without accounting for INFLATION), you would have:

Starting at 50: R$232,339.10

Starting at 40: R$999,147.92

Starting at 30: R$3,529,913.77

Starting at 20: R$11,882,420.24

Starting at 10: R$39,448,923.10

"From simple investments to sophisticated trading strategies, we combine accurate data and empathy to transform market confusion into opportunities that benefit you."

Results from

Clients

Results from

Clients

See what my clients say about me.

Brokerage Advisory vs. Free Time Consulting

Brokerage Advisor

It’s similar to the salesperson who greets you when you enter a clothing store: they present various options, check stock, clarify doubts, and facilitate your purchase.

Function

Facilitate customer access to the investment products available at the brokerage, offer new products, and provide daily support.

Remuneration

Commission-based. The advisor earns commissions on the investment products they sell to clients. Since fixed salaries are rare in this profession, it’s essential to sell frequently or focus on higher-commission products, such as IPOs or COEs (which can generate up to 3% in commission).

Pros and Cons

- The client does not pay the advisor directly, as commissions are automatically deducted.

- This service is more accessible for beginners starting to invest with little capital.

- There is a conflict of interest, as the products that generate higher commissions for the advisor are not always the best investments for the client.

- Advisor turnover is high, making it difficult for clients to maintain a continuous relationship.

- Advisors are not responsible for guiding clients on personal finance, financial planning, and long-term strategies, which can be a drawback for those seeking to optimize their results.

Free Time Consultant

It’s like a tailor who takes your measurements, helps define your style, discovers your preferences in fabrics, patterns, and colors, and creates a custom wardrobe from scratch.

Function

Define the client’s profile, creates a personalized investment plan, assists in executing and maintaining that plan, teaches strategies, recommends specific assets in the appropriate amounts, advises on financial decisions, and provides daily support.

Remuneration

Fee-based. We receive compensation based on a small percentage of the client’s assets and are prohibited from accepting any commissions.

Pros and Cons

- Premium service that is quick and frequent, ideal for those who require more care with their money.

- Absence of conflicts of interest; the consultant earns more only when the client also profits or increases their assets under management, ensuring satisfaction.

- Focus on data-driven strategies and studies, perfect for those who prefer a more rational approach to their financial decisions.

- For investors with little capital, the cost may be higher than that of conventional advisory services.

- It’s essential to understand the client well to define the best strategies, which can be challenging, especially for those uncomfortable discussing financial issues.

Brokerage Advisory vs. Free Time Consulting

Brokerage Advisor

It’s similar to the salesperson who greets you when you enter a clothing store: they present various options, check stock, clarify doubts, and facilitate your purchase.

Function

Facilitate customer access to the investment products available at the brokerage, offer new products, and provide daily support.

Remuneration

Commission-based. The advisor earns commissions on the investment products they sell to clients. Since fixed salaries are rare in this profession, it’s essential to sell frequently or focus on higher-commission products, such as IPOs or COEs (which can generate up to 3% in commission).

Pros and Cons

Pros:

- The client does not pay the advisor directly, as commissions are automatically deducted.

- This service is more accessible for beginners starting to invest with little capital.

Cons:

- There is a conflict of interest, as the products that generate higher commissions for the advisor are not always the best investments for the client.

- Advisor turnover is high, making it difficult for clients to maintain a continuous relationship.

- Advisors are not responsible for guiding clients on personal finance, financial planning, and long-term strategies, which can be a drawback for those seeking to optimize their results.

Free Time Consultant

It’s like a tailor who takes your measurements, helps define your style, discovers your preferences in fabrics, patterns, and colors, and creates a custom wardrobe from scratch.

Function

Define the client’s profile, creates a personalized investment plan, assists in executing and maintaining that plan, teaches strategies, recommends specific assets in the appropriate amounts, advises on financial decisions, and provides daily support.

Remuneration

Fee-based. We receive compensation based on a small percentage of the client’s assets and are prohibited from accepting any commissions.

Pros and Cons

Pros:

- Premium service that is quick and frequent, ideal for those who require more care with their money.

- Absence of conflicts of interest; the consultant earns more only when the client also profits or increases their assets under management, ensuring satisfaction.

- Focus on data-driven strategies and studies, perfect for those who prefer a more rational approach to their financial decisions.

Cons:

- For investors with little capital, the cost may be higher than that of conventional advisory services.

- It’s essential to understand the client well to define the best strategies, which can be challenging, especially for those uncomfortable discussing financial issues.

How to Start?

How to Start?

The first step to optimizing your portfolio starts here.

If investing rationally to ensure a more prosperous and secure future is important to you, I invite you to click on “Let’s Talk” and fill out the form to schedule a chat on Zoom.

During our conversation, we will discuss your current portfolio, your goals, desires, and concerns. This way, we can clarify whether consulting is truly the best option for you.

If you are not satisfied with the growth of your assets and feel there is room for improvement, this meeting could be extremely useful and generate valuable insights.

I look forward to hearing from you!

P.S.: Don’t forget to read the green columns to understand how the process works.

Ready to Start?

"In the circus of opinions and emotions in the market, numbers act as the 'mute' button, silencing the noise and allowing us to make more rational decisions."

Free Time

Consulting

Free Time

Consulting

Wesley Pinheiro is authorized by the Securities and Exchange Commission to act as a securities consultant, according to CVM Resolution No. 19 of February 25, 2021. The securities consulting services are provided independently and based on solid foundations. Investment recommendations are made based on the risk profile of investors, properly developed in accordance with current regulations, and it is up to them to accept or reject these recommendations. Investments in stock markets, over-the-counter markets, and future settlement markets are subject to risks, and investing in derivatives can result in losses greater than the initial investment. All content on this site is the property of Free Time Consulting and may not be reproduced without proper permission.

Wesley Pinheiro is authorized by the Securities and Exchange Commission to act as a securities consultant, according to CVM Resolution No. 19 of February 25, 2021. The securities consulting services are provided independently and based on solid foundations. Investment recommendations are made based on the risk profile of investors, properly developed in accordance with current regulations, and it is up to them to accept or reject these recommendations. Investments in stock markets, over-the-counter markets, and future settlement markets are subject to risks, and investing in derivatives can result in losses greater than the initial investment. All content on this site is the property of Free Time Consulting and may not be reproduced without proper permission.